The Beginner's Guide to Filing Taxes as a Reseller: Everything You Need to Know

*If you purchase something linked on our site, we may receive a commission. Learn more here.

Introduction

You decided to sell some of those old pieces in your closet that you never wear anymore. And to your surprise, they sold pretty quickly on eBay! It motivated you to post a few more items, and your bank account numbers went even higher. Before you know it, you’re going on treasure hunts to thrift stores to find other items you can sell for a profit. Then you’re counting the days until you can quit your job and just sell stuff full time.

This is a common experience among many of my reseller clients. It’s thrilling and satisfying to source and sell, but inevitably you will face the reality of paying your own taxes. It often opens a whole new world of things such as income tax, self employment tax, sales tax, deductions, etc. Where does one even start when it comes to tax preparation?

The good news is that it’s almost always simpler than you might imagine. In this post, I’ll cover the main things you need to do to get ready for and feel confident about how to do taxes as a reseller.

What are Reseller Taxes?

If you’ve ever worked as an employee and received a paycheck, you have likely noticed that part of your paycheck is going straight to the federal government (and probably to your state government as well). Your employer withholds and remits those taxes on your behalf all throughout the year.

When you start selling stuff on your own, the IRS considers you to be self-employed, and now you’re the one responsible for paying your own taxes throughout the year.

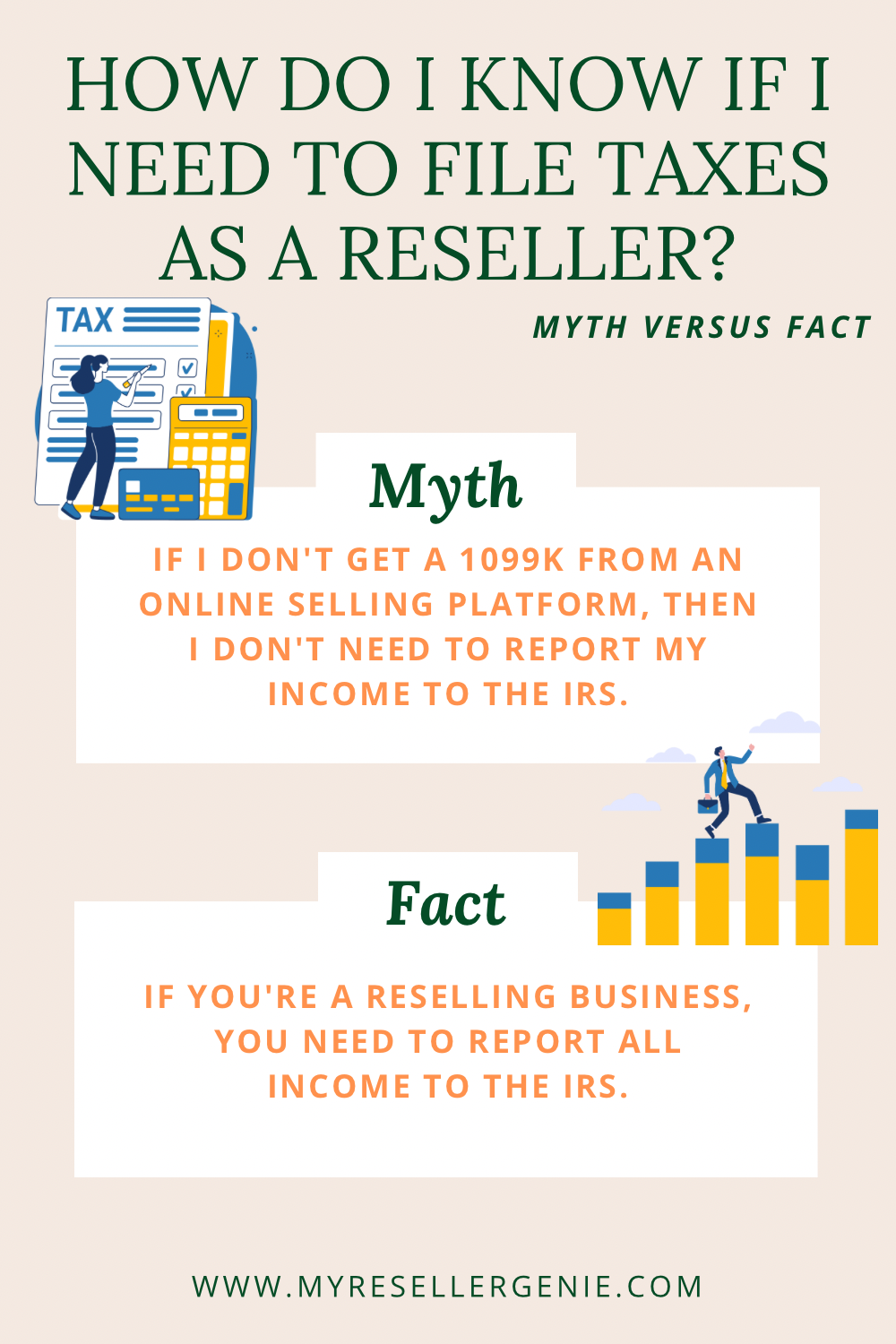

When you sell things on a platform such as eBay, Amazon, Poshmark, Facebook Marketplace, etc. with the intent to earn a profit, you are by default a sole proprietorship. Many believe that if the platform does not send them a Form 1099k that they don’t have to report the income received on their taxes, which is unfortunately incorrect. In other words, even if you don’t receive a 1099k from the online platform, you still typically need to report your income on your taxes.

Related post: Understanding the eBay 1099k: Everything You Need to Know

Most reseller businesses are sole proprietorships. If you have a sole proprietorship or single member LLC, your business activity is reported on what’s called a Schedule C. This is a schedule that is part of your individual income tax return. It’s where you report your income and various business expenses. If you are preparing your income tax return yourself, the program you use will likely ask you various questions in order to generate the Schedule C. What’s left over is your profit or loss, which is added to your overall income in order to calculate if you owe any additional tax.

Why is Filing Taxes as a Reseller Important?

Filing reseller taxes is not only a critical part of staying legally compliant with tax laws, but also for your own peace of mind. Having a baseline understanding of what you need to do works wonders for your confidence and allows you to focus more on growing your business rather than stressing about following tax rules. Properly tracking your numbers and optimizing your deductions ensure that you aren't paying more taxes than you should. I see too many resellers failing to claim the deductions they are entitled to either because they are nervous about being audited or because they don’t know that they can.

Tips for Filing Taxes as a Reseller

1. Separate your banking activity

Having a separate bank account for your business transactions is a must. It lays the foundation for enabling you to effectively track your business activity. Even if you have a business credit card, I recommend linking it to a separate account you use specifically for your business. It just makes life a whole lot less complicated by reducing the chance of mixing up business and personal finances.

If you don’t already have a preferred bank, you can easily find some good options that don’t burden you with monthly transaction fees or minimum balance requirements. Don’t let this step hold you back. It’s surprisingly easy to set up a new bank account.

2. Track your income & expenses

Many business owners recoil at the thought of managing “the books,” but these days it is less painful than ever. Before you outsource your bookkeeping (or give up on it completely), consider a do-it-yourself solution.

There is not one size fits all. As a small business owner, you can use anything from a simple spreadsheet all the way up to a robust bookkeeping program with all the bells and whistles. Most of my clients aren’t at the level where they need all those bells and whistles. There are a handful of better-suited options, such as My Reseller Genie which is designed with resellers in mind.

3. Make estimated tax payments

Not everyone needs to make estimated payments. It essentially depends on your profitability and the extent to which you have tax being withheld from other sources. Failing to pay the proper amount during the year can trigger late penalties and interest.

In general, you only have to make quarterly estimated payments if you expect to owe more than $1,000 for the year (after subtracting prior payments and withholdings). If you fall into that category, you need to determine if you’ve already paid 90% of the total tax you’ll owe for the current year OR 100% of the total tax for the prior year. If what you’ve paid in exceeds those thresholds, you won’t need to make any estimated payments. Otherwise, you may need to make additional payments.

4. Deduct your business expenses

Some resellers are hesitant to include some of their business expenses as deductions because they don’t want to attract IRS attention. But I highly encourage you to deduct everything you are legally able to! If you have proper records, you have nothing to fear. Almost all of the expenses you incur as part of the operation of your reselling business will be fully or at least partially deductible. Common fully deductible expenses include inventory, supplies, platform fees, software, business training, business conferences, and so on. By claiming all of the deductions you're entitled to, you'll not only lower your taxable income but also ensure you're maximizing the profitability of your reselling business. Don't leave money on the table—stay organized and take advantage of these valuable tax benefits!

Related post: List of Tax Write-Offs Every Reseller Should Use

5. Consider hiring a tax preparer

With every big change in your life often comes an additional layer of complexity in your tax situation. Marriage, kids, death, divorce, college, a new business, a new investment, a rental property, and so on. The more complicated your financial situation, the more complicated your taxes will be. Not only will working with a tax pro give you a much higher chance of fewer mistakes and more tax savings, but you will also likely feel a huge sense of relief that comes with being able to focus on growing your business without the task of tax preparation looming over your head.

Common Questions About Filing Taxes as a Reseller

How do I handle taxes as a reseller?

As a reseller, handling taxes involves tracking all income and expenses related to your business. You’ll need to report that activity on your tax return. That activity typically goes on the Schedule C of your individual tax return. The expenses you incur will be listed and deducted against that income. That’s why keeping detailed records is so important!

Is reselling earned income?

Yes, reselling income is considered earned income because it’s money you make from actively running your business. It’s subject to self-employment tax as well as income tax. If you resell as a hobby income or full-time job, the IRS treats it like any other business taxable income.

What are acceptable reasons for not filing tax returns?

The IRS typically requires you to file a tax return if your income is above the minimum threshold for your filing status. Acceptable reasons for not filing could include earning less than the threshold, being a dependent with limited income, or qualifying for certain exceptions like some Social Security recipients. However, it’s always best to double-check your specific situation to avoid having a tax liability or missing out on refunds.

Can I sell online without paying tax?

Assuming you end up with a profit, you could forego paying tax, but then you’d likely be breaking the law! That would be considered tax evasion, which is illegal. Tax avoidance, on the other hand, is 100% legal! The difference is that tax avoidance is simply using strategies to legally reduce and optimize your tax bill. That’s where seeking a baseline understanding of taxes or working with a tax professional can really pay off.

Conclusion

Filing reseller taxes might seem overwhelming at first, but understanding the basics and taking proactive steps can make the process much smoother. Remember, staying organized, tracking your finances, and claiming all eligible deductible expenses are essential for staying compliant and maximizing your profitability.

Don’t let fear of the IRS stop you from deducting what you’re legally entitled to. With proper expense records and a clear understanding of your obligations, you can confidently navigate tax season and focus on growing your reselling business.

*As an Amazon associate, I earn from qualifying purchases.